For use during the course and in the examinations. Net income on a per share basis is referred to as EPS or earnings per share.

Maths Formulas For Class 11 Cbse Important Maths Formulas

These essential Maths formulas.

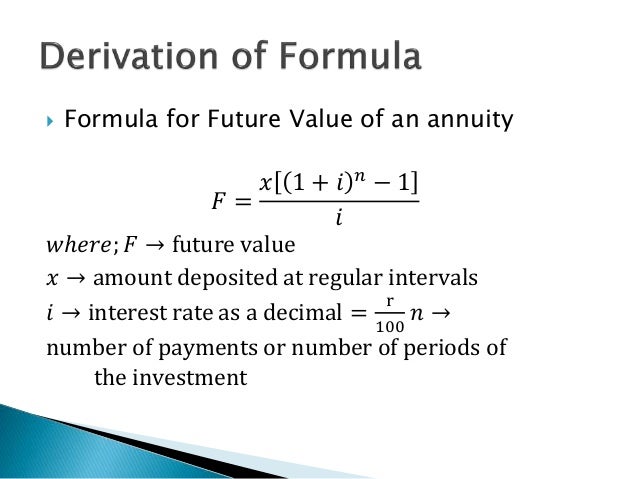

Book value formula math. Summations rn nn r n 2 1 1 6 12 1 rn n r n 3 1 1 4 22 1 Numerical solution of equations The Newton-Raphson iteration for solving fx 0. X n S xx Σx i. Mathematics HL and further mathematics HL formula booklet.

Compare and take the pile which has the greater value. The Market to Book formula is. 8 Pearson Edexcel Level 3 Advanced Subsidiary and Advanced GCE in Mathematics and Further Mathematics Mathematical Formulae and Statistical Tables Issue 1 uly 2017 Pearson Education Limited 2017 Standard deviation Standard deviation Variance Interquartile range IQR Q 3 Q 1 For a set of n values x 1 x 2.

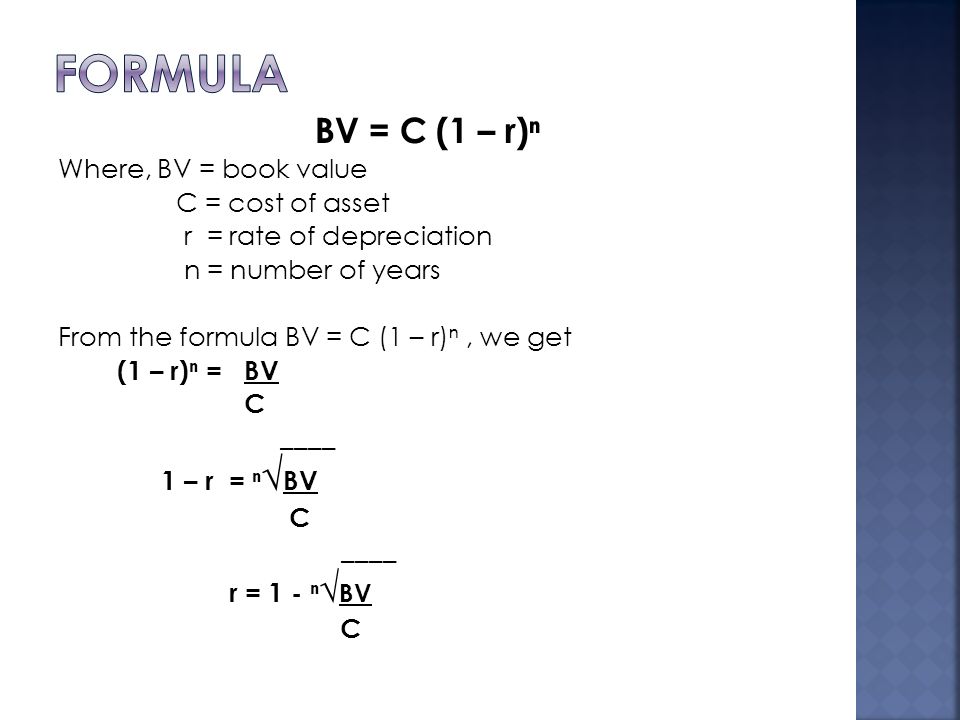

Edited in 2015 version 2 Diploma Programme. Book Value Cost - Accumulated Depreciation For example Michaels 2014 sports car cost 60000 when he purchased it. We write 20.

Alternatively Book Value can be calculated as the sum total of the overall Shareholder Equity of the company. To use a block equation wrap the equation in either or begin statements. This allows you to focus attention on more complex or longer equations as well as link to them in your pages.

You probably dont need to include every word of the title and authors name. To calculate the book value of a company you subtract the value of its total liabilities and intangible assets from the value of its total assets. How much is your book worth.

Book Value formula calculates the net asset of the company derived by total of assets minus the total liabilities. 22062021 To calculate the book value of an asset you subtract its accumulated depreciation from its original cost. The price to book value ratio PB formula is also referred to as a market to book ratio and measures the proportion between the market price for a share and the book value per share.

Share Price Net Book Value per Share. 218 EQUITY VALUATION RISK AND INVESTMENT Then we turn to the fundamental accounting and cash flow equation of conservation. Where Net Book Value Total Assets Total Liabilities.

It is worth keeping in mind a little memory trick with these inequality signs. Heres the formula of price to book value Price to Book Value Ratio Market Price Per ShareBook Value per Share. The sign we use is.

Mean n Total number of items. The formula for calculating book value per share is the total common stockholders equity less the preferred stock divided by the number of common shares of the company. The thought being that the mouth always eats the larger number.

Formula to Calculate Book Value of a Company. 6 Pearson Edexcel IASIAL in Mathematics Formulae List Issue 1 June 2013 Further Pure Mathematics F1 Candidates sitting F1 may also require those formulae listed under Core Mathematics C12. Where x Items given x.

Xx x nn x n n. Market to Book Ratio Formula. The easiest way to know how much your copy of a book is worth on the open market is to check on how much similar copies are currently being offered for.

Vedantus Maths formulas download free has benefits for all. You can also include math blocks for separate equations. Market Capitalization Net Book Value.

Book value per share is also used in the return on equity formula or ROE formula when calculating on a per share basis. Vedantus Maths formulas PDF empower students for hands-on practice and help them to score high both in-class exams and boards. Fill out this form with enough information to get a list of comparable copies.

In accordance with the cost principle of accounting assets are always listed in the. Mathematically we need some notation to represent that 20 is greater than 15. Mean n Total number of items.

18022018 The market to book ratio is calculated by dividing the current closing price of the stock by the most current quarters book value per share. 25052011 The book value of an asset is its original purchase cost minus any accumulated depreciation. ROE is net income divided by stockholders equity.

First examinations 2014. The formula to calculate book value is as follows. Beginning Period Book Value plus Earnings less Dividends Paid plus Stock Issuance less Stock RepurchasesRetirements equals Ending Period Book Value We will find it easier to manipulate this basic conservation equation.

Where x Items given x. Where f i x i is the sum of observations from value i 1 to n And f i is the number of observations from value i 1 to n. For example int_0infty fracx3 ex-1dx fracpi4 15.

Gt10103 Business Mathematics Ppt Download

How To Calculate Book Value 13 Steps With Pictures Wikihow

11 Sequences Series Financial Mathematics Mathscafe Net

Pin By H Kubra Sihlaroglu On Avedhan ßatark Math Methods Studying Math Math Vocabulary

Pin By Yuvieyasara On Math Algebra Geometry Trigenometry Calculas And Physics In 2020 Math Tutorials Studying Math Math Formula Chart

Pin On Book Value Vs Market Value

Finance Formulas Owll Massey University

0 comments:

Post a Comment