The second investment example returns an internal rate of return of 2186309695 in cell E10. There is a full explanation online about how to use the XIRR function and here is an explanation from Microsoft.

Xirr Mathematical Formula Math Formulas

Let us calculate XIRR for above example.

Xirr formula math with example. The Excel formulas IRR and XIRR are designed to calculate the IRR under different scenarios. PV 100 110 2 8264. As an example the starting balance is 10000 with regular deposits and some gains totaling a portfolio balance of 15000 on Jun 27 2010.

PV 100 110 9091. The resulting value in fact is exactly same as the one computed by Excel using XIRR function for the original set of cash flows. Let us try 10 interest.

PV 100 110 3 7513. PV 2500 110 3 187829. It assumes that you have an initial cost of 5000.

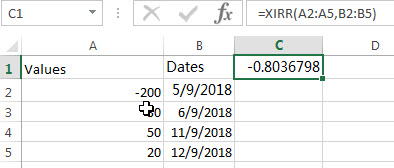

03102017 XIRR XIRR valuedatesguess Values are the transaction amounts dates are the transaction dates and guess is the approximate return. Adding those up gets. The underlying formula that XIRR utilizes is as follows.

800 on 5312016 1300 on 912016 600 on 12312016 and 7500 on 1312017. 22072015 CAGR vs XIRR. Di the ith or last payment date.

To calculate the internal rate of return for a series of regular periodic cash flows use the IRR function. Invest 2000 now receive 3 yearly payments of 100 each plus 2500 in the 3rd year. We will now see what the XIRR represents and how it is calculated.

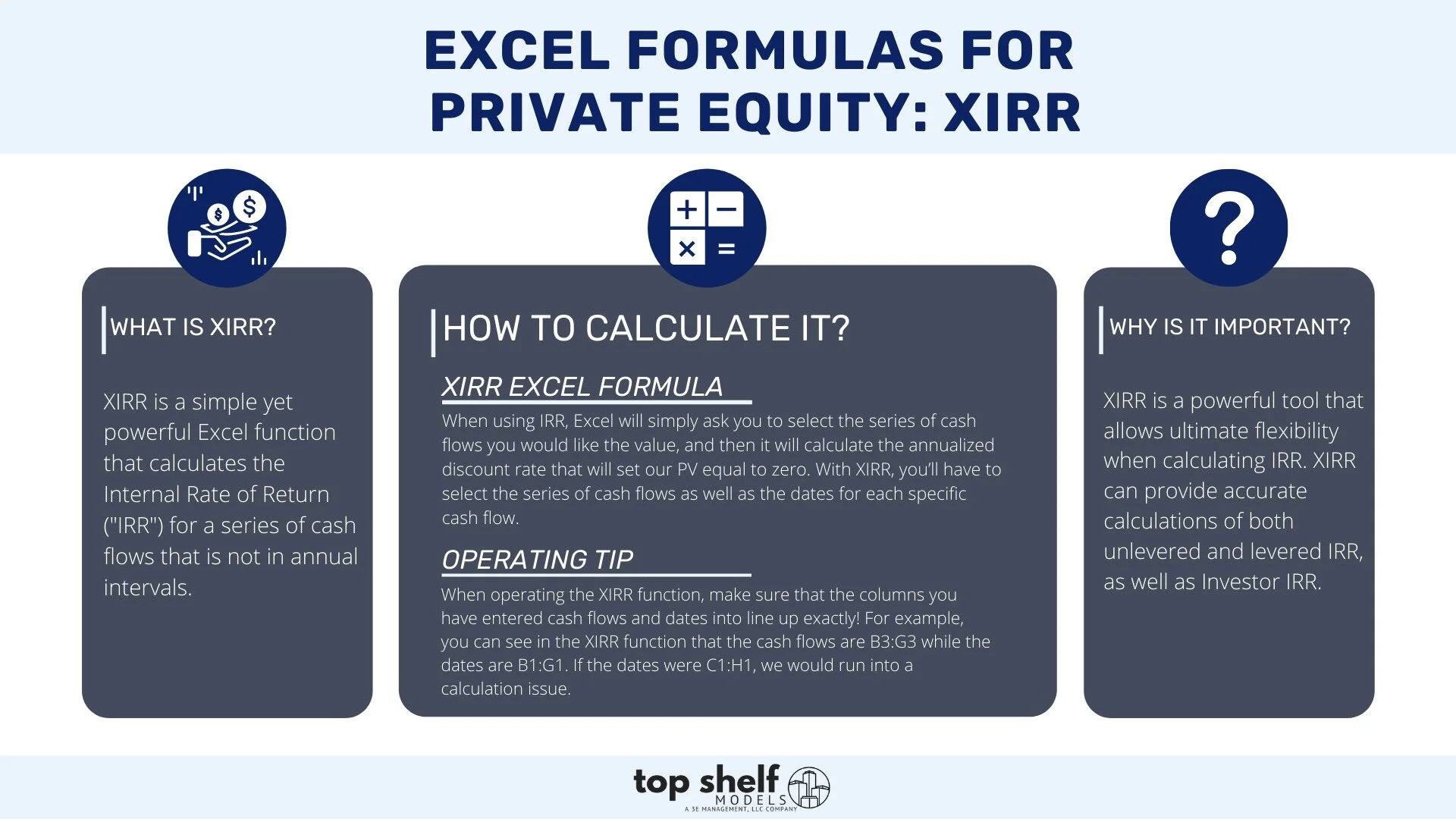

21102020 XIRR is a simple yet powerful Excel function that calculates the Internal Rate of Return IRR for a series of cash flows that is not in annual intervals. If the first value is a cost or payment it must. What kind of return are you trying to get.

D1 the 0th payment date. 12000 once a year for 12 years and wish to know what is the average rate at which my investments have compounded year after year the quantity that gives me information is the XIRR. 1Rdays365-1 While XIRR follows an annual compounding convention the compounding.

In fact XIRR compounds annually but it simply has the ability to provide results based on inputs from any given day. Payments are expressed as negative values and income as positive values. Yes we have calculated XIRR without the Analysis Toolpak Addin.

This is the annual SIP investment schedule. Ive got a bit of time so here it is - complete C code for XIRR calculation. The only time I mess with the formula is if I want a YTD return or some period less than one year.

This is the formula I used to do the calculation. The following formula calculates the internal rate of return of the CashFlows table. Thats where the XIRR feature in Excel comes in.

If the cash flow entries are not periodic then XIRR may be used to compute CAGR straightaway using the dates of payments and receipts. Error value is returned. Copy the example data in the following table and paste it in cell A1 of a new Excel worksheet.

Year 3 final payment. 21062011 XIRR is an annualized return. 01022017 In the example at left the MIRR formula would be MIRRD2D14D16D1712 which yields an internal rate of return of 1768.

09072012 This produced a return number based on XIRR of 1019 for the previous 12 months. F xirr after having f xirr and f xirr you can solve for xirr value by using iterative Newtons method - famous formula-. Some CPAs maintain that the MIRR functions results are less valid because a projects cash flows are rarely fully reinvested.

The XIRR function calculates in the internal rate of return for series of cash flows that occur at irregular intervals. With XIRR you can calculate annualized returns even when cash flow for your account is irregular. The Internal Rate of Return IRR is the rate r at which the Net Present Value NPV of all future cash inflows and outflows CF for a project is zero.

To refresh IRR is the annualized discount rate r in the formula below that sets the Present Value PV of a project equal to zero. If XIRR cant find a result that works after 100 tries the NUM. XIRR B2B9A2A9 where the amounts were in the B column and the dates were in the A column.

The invested amount and amount redeemed or current value should have opposite signs positive or negative for the purpose of calculation. 15092013 For example if you pay insurance premium for 12 months and receive some cash back in the 13 th month you could calculate the monthly IRR and then convert to a CAGR compounded annual growth rate XIRR. Using XIRR to Calculate Annualized Returns.

02032011 You can calculate xirr value by. XIRR CashFlows Payment Date. The rate is changed until.

20012016 Entity agreements might address this problem by either requiring the result of the XIRR function to be converted to the nominal rate with the appropriate compounding using Excels nominal function or by adding language to the IRR definition such as IRR will be calculated with quarterly compounding using the following formula. If you want an XIRR for those dates use the simple formula. You then have the following income.

Pi the ith or last payment. The fact that XIRR can generate daily results does not mean it compounds daily. Finally in Step 3 the result in Step 2 is further refined using the formula 1 R 365 365 - 1 where R is the the value obtained in Step2.

Suppose I invest Rs. Calculating derivative of above function -.

Excel Xirr Function Free Excel Tutorial

Excel Formulas For Private Equity Xirr Top Shelf Models

Xirr Mathematical Formula Math Formulas

Excel Xirr Function Examples Tutorialsforexcel

Oh Another Language Is Too Hard Learning Is Not A Spectator Sport

What Is The Xirr Function In Excel Quora

Xirr Guessing Games And Distribution Waterfalls

Excel Xirr Function Producing Unexpected Irr Quantitative Finance Stack Exchange

0 comments:

Post a Comment